America is at a Crossroads.

For the last two generations, the success plan was clear.

Go to school > get good grades > go to college > get a good job.

If you followed that plan and had a good work ethic, a successful middle-class lifestyle would come easily to you.

Back then, there were very few roadblocks to starting a business. Opportunity was everywhere.

That was the American dream. It’s what inspired countless immigrants to leave their homeland to create a new life in this country.

But that dream is fading.

It’s fading because we no longer respect the ideas of liberty and independence that America was built on. As a result, reckless government spending has driven up everybody’s cost of living dramatically.

The government finances its spending by printing more and more money. It’s debt-based money, which the US borrows from the Federal Reserve Bank and must pay back, with interest—financed with our taxes.

The monetary policy of inflating the money supply, famously called quantitative easing, which the Fed employed after the 2008 financial crisis, reduced interest rates but increased consumer prices.

Recently the Fed has been practicing quantitative tightening, which has sent interest rates higher but hasn’t lowered prices for consumer goods and services. Because the damage has already been done.

Decades of ever-rising consumer prices has been wiping out the middle class. And now with normalized interest rates, it’s become even harder for Americans to build a middle-class life.

And that’s not just an opinion. It’s evident in all the data. Today I have two tables for you that spell it out. First, look at this…

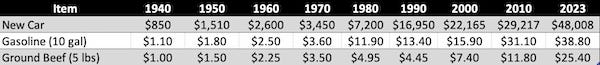

This table tracks, from 1940 to now, the median price of a new car, the price of ten gallons of gas put into that car, and the price of five pounds of ground beef.

As we can see, it’s not a pretty picture. Prices for all three products have risen dramatically over every ten-year period in modern history.

That said, we have to compare these costs to the median income to get a better feel for the story. And that’s what we can see in in this table...

Here, we’re tracking the median home price compared to the median annual income going back to 1940.

As was the case with new car prices, home prices have risen significantly every decade. But incomes have, too. So, it’s that third line, “Income to Home Price,” that we need to focus on. It shows us exactly what percentage of the median home the average salary can cover.

A median-priced home costs $430,300 today. The median annual income is $74,580. That means the average person’s salary can cover only 17% of the median home price.

We can see just how dramatic today’s income-to-home price differential is by looking at past data.

For instance, if we go back to the turn of the century, the median income in the year 2000 could cover 33% of the median home price. That’s nearly twice as much as can be covered today.

Then, if we go back to 1970, the median salary covered more than half of the median home price: 54%. If the average American’s income were to cover 54% of today’s $430,300 median home price, he would have to bring in $232,362 annually—or approximately three times as much as today’s average income-earner is actually making.

What these numbers illustrate is that it has become harder and harder to live a comfortable middle class life in the United States because inflation has eroded the value of our dollar… thus, costs have risen far faster than incomes.

And now we’re faced with a new threat that could make this dynamic even worse.

In June 2020, an international organization called the World Economic Forum (WEF) announced what it calls the “Great Reset” initiative. The WEF pitched it as an economic recovery plan in response to COVID-19… but that was just the cover story.

Important! If you like this newsletter and you like our mission of championing individual freedom and peacefully standing up to those who want to subdue the human race, then please support us. We are truth seekers and this is rare in today’s world of activist journalists and commentators who try to stoke the division and hate that is consuming our country. Support from our readers will determine whether we are able to succeed in our mission. Plus, members receive benefits, such as having access to our Underground Livestream every month.

The Great Reset is an all-out attack on market-based capitalism, free enterprise, conventional energy production, and the traditional values that made America and western civilization great.

And that’s not an exaggeration. These people were arrogant enough to make a commercial that pitches the slogan, “You’ll own nothing and be happy”.

Central to their plan is the implementation of central bank digital currencies (CBDCs).

Implementing CBDCs is the tip of the spear that is intended to reset the entire financial system—at least if the World Economic Forum (WEF) globalists have their way.

And it all starts with redefining what money is . . . and our relationship to it.

The CBDC will redefine money.

The WEF-globalists, in league with the central banks of all countries, are intent on making all money digital and programmable. I’m sure they will hail it as “smart” money. I’m equally sure the establishment media will fawn over how this smart money is so much better than the country-specific currencies we have had up to now.

But hold on! Don’t believe their platitudes. That programmability they are dead set on creating is what would allow our money to be turned into an object with which the globalists can manipulate and control us. That is to say, they’ll use it as a “carrot and stick” system to strongly encourage us to do and say the things they want us to do and say.

If we fall in line with their preferred lifestyle for us, we’ll be able to spend our CBDC money freely at all approved locations. They might even give us a bonus for good behavior. They could credit our CBDC wallet with additional funds if we’re extra-compliant.

But if we don’t comply, we may face penalties.

Perhaps we’ll find our money frozen for a period of time. Like a school teacher scolding disobedient students, they’ll put us in a time-out. Or perhaps, like bullies, they’ll confiscate half of our funds for bad behavior—with the promise to restore our balance if we shape up.

In addition, the programmable nature of CBDCs will enable the globalist power structure to engage in coordinated “stimulus” policies.

When the economy begins to slow, they could inject extra CBDC money into our wallets . . . but with a catch. That new money would be programmed to expire within a certain period of time. If we didn’t spend it in an approved way before the timer hit zero, it would vanish.

So, it’s not a stretch to say that CBDCs are about financial enslavement.

Sure, it may be a soft version of slavery. And there would almost certainly be plenty of carrots to go with the sticks. But slavery is slavery, no matter how you slice it.

Now, there are plenty of individual solutions we can each implement to mitigate this attack on our liberty. Glenn and Eric’s newly named Privacy Academy is chock full of them. I, too, have quite a few mitigating solutions we can each make on the finance and investment side as well.

But if we want an all-encompassing solution to the problem, there’s only one fix: the restoration of sound money, which we once had in this country.

To understand what happened to our money, we must first understand what money is, and what characteristics it must contain.

Now, I know that may sound a little strange. We all use money every day. We’re familiar with it. But have we really thought about it?

Where does money come from? Why is it valuable?

What Is Sound Money?

The short answer is that money is a unit of account that serves as a medium of exchange.

Stated more clearly, money is a way to measure value. We use it to pay each other for goods and services. Anything that serves these two purposes can serve as money.

But, to be viable over long periods of time, money must contain several additional characteristics. Money must be:

Portable

Divisible

Fungible

Durable

Let’s examine each of these characteristics in more detail.

(1) Money must be portable. Not hard to explain: We need to be able to carry money with us and transfer it easily to others.

(2) Money must be divisible. This one’s easy, too: We need to be able to make change out of our money. It should break down into consistent smaller units that add back up to consistent larger units.

(3) Money must be fungible. This is a fancy way of saying that money should be uniform. A US dollar in my pocket should be the same as a US dollar in your pocket. A Euro in my bank account should be the same as a Euro in your bank account. A one-ounce gold coin in my safe should be the same as a one-ounce gold coin in your safe. A Bitcoin in my wallet should be the same as a Bitcoin in your wallet. You get the point.

(4) Money must be durable. To be viable over long periods of time, money needs to serve as a store of value for us. We should be able to save our money and come back to it in a year . . . or in 10 years . . . or in 50 years and still be able to buy things with it. In other words, good money should maintain its purchasing power over long periods of time.

For money to be durable and retain its purchasing power over time, it must be relatively scarce. Otherwise, people would not want to trade goods and services for it. This is why rocks and seashells don’t work as money. They’re too abundant.

This is just basic supply and demand economics.

We can categorize any money that adheres to all of these principles as “sound money.”

Sound money is important because it keeps consumer prices from rising dramatically—spiraling up as we saw in the tables above. Sound money is also important because we need it in order to have a vibrant middle class.

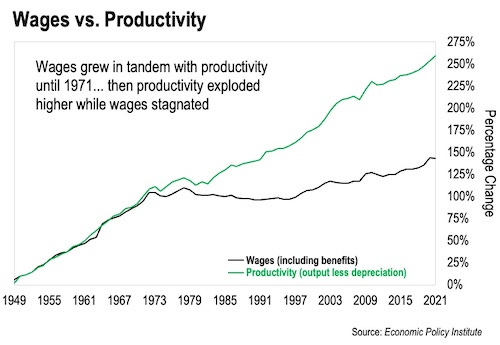

I have another chart to share with you that demonstrates this point:

This chart compares the growth in median US wages, adjusted for inflation, against total American productivity. The data spans the period from the late 1940s to the present day.

It’s clear that wages and productivity were in sync until 1971. The average person’s salary increased proportionally with America’s output of goods and services. Just as it should.

But look at what’s happened since then. Our productivity powered forward, but our inflation-adjusted wages stagnated.

Why?

In 1971, President Richard Nixon cut the dollar’s last link to gold. Up to that point, foreign countries could exchange their dollars for gold through what was called the “gold window.”

This prevented the US government from printing too much money. If it had, foreign countries would respond by exchanging all their dollars for gold.

But once Nixon closed the gold window, all bets were off.

Suddenly, the government could print as much money as it wanted to. The only consequence was that the dollar gradually lost its purchasing power. That’s what drove prices higher.

Look at what has happened to our dollar since 1970:

This chart comes directly from the Federal Reserve Bank. The Fed’s own data shows that the US dollar has lost nearly 88% of its purchasing power since 1970. This is why nearly everything has increased in price dramatically.

No wonder it has become so difficult for all but the wealthiest Americans to get ahead financially.

When we see our cost of living rising across the board, it’s not because everything is getting more expensive. It’s because the dollar has lost so much of its purchasing power—and that’s because the government—the Fed—has been free to print new dollars at will.

But it doesn’t have to be this way.

The Sound Money Solution

My friends, the darkness cannot survive the light.

We can see, clear as day, what the Fed and the government have done to our money. They have destroyed nearly 88% of the dollar’s purchasing power since 1970, dramatically driving up our cost of living across the board.

And now the globalists’ plan for a CBDC, unspoken and unseen up until now, is out in broad daylight. It’s nothing short of a plot to financially enslave us.

The solution is for us to get back to sound money. And it all starts at the personal level.

For starters, we can each move some of our money into gold, silver, Bitcoin, and/or Monero. Doing so insulates our money from inflation and will protect its purchasing power long-term.

There’s no law that says we can’t pay for goods and services using these alternative forms of money.

Returning to sound money has the potential to create a circular economy of sorts. That is, the more our local farmers and our local business owners accept sound money in exchange for their goods and services, the larger the circular economy becomes.

What we’re talking about here is what America was supposed to be—and perhaps was for a little while. A land of free people conducting their lives and running their communities as they saw fit.

I realize this may sound too idealistic . . . but the sound money movement is already underway.

I now pay for my haircuts with Bitcoin. And I hope to start buying meat, eggs, and produce from my local farmers using Bitcoin also. It’s just a matter of getting the local farmers set up with the infrastructure they need to accept alternate payments.

My friends at the non-profit Bitcoin Bay are even farther along than I am. They are educating farmers and small businesses in the Tampa Bay area on Bitcoin. They show these companies exactly how to accept Bitcoin as payment for goods and services. This includes training in Bitcoin accounting procedures and good practices.

Bitcoin Bay has successfully onboarded a wide range of local businesses in Tampa. That, in turn, is created a circular economy based on Bitcoin.

Looking in the Tampa business directory, we can find ranchers, berry farmers, personal trainers, auto mechanics, accountants, roofers, hair stylists, and many others who now accept Bitcoin as payment. That means folks here can buy goods and services from these companies using Bitcoin without ever needing to move back into dollars.

But we don’t have to be limited to just Bitcoin. Goldbacks and silver coins could work just as well.

The key is that we should think seriously about creating a market for sound money now—ahead of the coming CBDC push. I say that because up to this point all the advice in alternative financial circles has been to hoard these alternative assets.

Sure, maintaining a reserve of gold, silver, Bitcoin, and Monero certainly has its place in a thoughtful financial plan. But if we’re serious about avoiding a CBDC and restoring sound money to this country, we must actually use the tools we have available.

We can also accelerate the restoration of sound money dramatically at the state level.

As I write this in February 2024, eleven states have legalized gold and silver as legal tender. They are (in alphabetical order): Arizona, Indiana, Kansas, Louisiana, Oklahoma, South Carolina, Tennessee, Texas, Utah, West Virginia, and Wyoming. A similar bill is pending in the Missouri legislature.

In addition, many other states are currently developing bills and regulations to allow people to use gold and silver as legal tender. We should encourage this. I’d love to see Bitcoin recognized as legal tender as well.

Having gold, silver, and Bitcoin authorized as legal tender would be a great step towards restoring sound money in this country. It would give us alternatives that we can fall back on immediately in the event of economic turmoil, continued inflation, and the rollout of CBDCs.

So, if I may, I’d like to close with a note of hope and optimism.

Matthew quotes Jesus of Nazareth as saying, “The kingdom of heaven is at hand.” Throughout the gospel, Jesus spoke at length about the necessity for his followers to adopt a new morality and a new lifestyle based on the Golden Rule: “All things whatsoever ye would that men should do to you, do ye even so to them” (Matthew 7:12).

Using sound money is a major way we can move our society back in that direction. Sound money gives us the ability to create ecosystems based on voluntary transactions—transactions that drive mutual benefit for all parties involved.

What’s more, the restoration of sound money will unlock a world of abundance for humanity.

The fact that our money constantly falls in value is what creates artificial scarcity. By that I mean we all have to squeeze every single dollar we earn because so much of our purchasing power is being taken from us.

Sound money will fix that.

And once it does, it will be far easier for all of us to make a living and create financial security for ourselves and our families. From there, we’ll have the ability to invest in making our communities vibrant and resilient once again.

At the time of the American Revolution, a gentleman named Thomas Paine wrote a pamphlet called “Common Sense.” It caught on like wildfire. The very first line reads: “We have it in our power to begin the world over again.”

I think we’re right back at that point today. But in our remaking of the world, our most powerful tool must not be violence. That doesn’t work, and it’s not in accordance with the Golden Rule.

Instead, the tool we have that the globalists fear more than anything else is sound money. That said, it’s just a tool. We are the ones who have to use it—and use it wisely.

Indeed, “we are the ones we’ve been waiting for.”

Let’s make it happen.

Editor’s Note: We invited Joe to write this article for the Liberty Zeppelin because of his background in investing and his perspective on the economy. He is also an advertiser in this month’s issue.

Please support our sponsors…

MyPureWater.com is a USA-based company that produces the highest quality water purifiers on the market today. Founded in 1968, they hand-craft stainless steel water distillers that produce consistently pure drinking water. Mention “The Liberty Zeppelin” for 10% off. Go to MyPureWater.com or call 402-467-9300.

Big tech and big brother watch and record everything you do online without your knowledge or consent. Privacy is vital for freedom and security. The Privacy Action Plan is a comprehensive online course that teaches you how to secure your online privacy and security. We provide a planned way forward and break each topic into bite-sized steps that even non-techy people can do. Learn more here.

Josh Taylor, CFP®, Certified Financial Planner ™. For all your financial needs. jt@kompassfinancial.com 888.770.0004 www.kompassfinancial.com

Unlock Your Financial Destiny with the Finance for Freedom Masterclass. Go to financeforfreedomcourse.com